Sustainable Artificial Intelligence Carbon Credit Program (SAICCP)

Network: Binance Smart Chain (BEP‑20)

Token Type: Utility Token (platform access and protocol functions only; no equity, dividends, profit participation, or asset ownership).

Document Controls

This document consolidates prior discussions into a single diligence-ready draft, including tokenomics, sale mechanics, market design, carbon integrity controls, revenue routing, and scenario-based simulation mechanics.

Locked headline parameters (Option A): Total supply 369,000,000,000 SAI; Private raise $5,000,000; Public raise $20,000,000; Trading fee 25 bps; Listing reference 550 SAI/USDT; Retirement fee target $0.15/tCO2e.

1. Executive Summary

SAICCP is a blockchain-based platform designed to transform access and usability of voluntary carbon credits through tokenization, marketplace trading, and immutable retirement workflows. The platform supports transparent acquisition, transfer, and retirement of verified carbon units, with an auditable trail suitable for institutional reporting.

SAICCP aims to reduce market friction by addressing liquidity constraints, verification overhead, and trust deficits, while maintaining environmental integrity through registry linkage, attestations, and audit controls.

Capital formation targets: $5M private sale and $20M public sale. Inventory objective: ~$100M equivalent of verified carbon credit inventory supported on-platform via treasury facilities and third‑party verified onboarding.

2. Problem Statement

Traditional carbon credit markets are impacted by:

• Costly and opaque trading processes with fragmented venues and inconsistent price discovery

• Limited accessibility for smaller buyers and complex procurement workflows for enterprises

• Trust erosion from double-counting risk, inconsistent retirement claims, and limited audit trails

• Slow verification and reconciliation across registries and intermediaries

3. SAICCP Solution Overview

SAICCP provides an integrated digital carbon credit lifecycle:

• Tokenization of carbon units with registry-linked metadata and attestations

• Marketplace trading with transparent fee routing and market integrity controls

• Retirement with on-chain finality (burn) and off-chain reconciliation evidence anchoring

• Staking participation funded primarily by usage-based revenue (fees and enterprise services)

4. Market Overview & Investment Opportunity (Non‑Promissory Framing)

SAICCP is positioned to serve enterprises, institutions, and ecosystem partners seeking verifiable climate action instruments. The platform’s design prioritizes auditability, transparency, and operational efficiency, enabling users to acquire and retire carbon units with clear evidence trails.

The platform may support secondary market participation where permitted, enabling improved liquidity and price discovery for verified carbon units.

5. Technology Stack & Features

Blockchain protocol: Binance Smart Chain (BSC), BEP‑20 token standard.

Smart contracts: token issuance controls, marketplace execution, staking vaults, and retirement manager.

Wallet integration: BSC-compatible wallets (e.g., MetaMask, Trust Wallet).

Explorer tools: transaction visibility via public explorers (e.g., BscScan).

Off-chain services: registry adapter layer, indexing/analytics, enterprise reporting, and compliance tooling.

6. Carbon Credit Integrity Framework

6.1 Registry Onboarding Process

Eligible credits are onboarded through a controlled process requiring registry linkage and complete metadata:

1) Eligibility screening (methodology, project type, geography, quality criteria)

2) Document capture (verification reports, issuance records, ownership chain evidence)

3) Attestation + internal validation gate

4) Mint authorization and batch creation

5) On-chain anchoring of attestation package hash (registry anchor)

6.2 Third-Party Audit Flow

Audit checkpoints occur at onboarding, at periodic intervals (recommended quarterly), and on anomaly-triggered events.

6.3 Double-Counting Prevention

SAICCP enforces one-to-one linkage between carbon unit tokens and registry references. Retirement burns the carbon unit tokens and anchors evidence to prevent reuse.

6.4 AI-Assisted Anomaly Detection

Monitoring includes issuance velocity anomalies, reconciliation mismatches, abnormal wallet clustering, and market irregularities requiring manual review.

7. Token Model (Utility + Carbon Unit Separation)

SAICCP uses a two-asset model to avoid conflating utility token economics with carbon unit representation:

• SAI: utility token used for fees, staking participation, access controls, and protocol operations.

• cSAI: carbon unit token representing 1 tCO2e per cSAI (fractional supported).

Retirement burns cSAI units on-chain. SAI burn may be executed via policy-defined mechanisms funded by revenue.

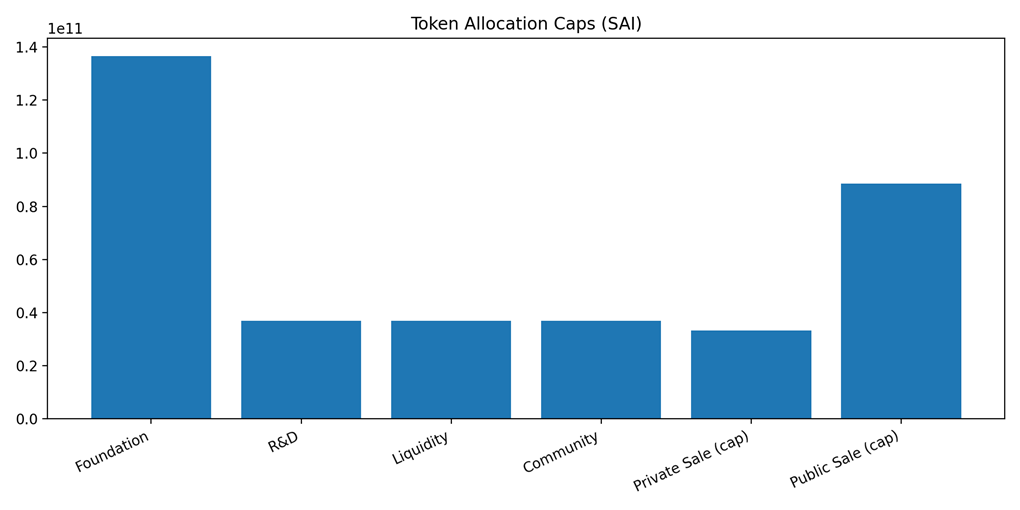

8. Tokenomics (Allocation Caps) — Total Supply 369B

| Bucket | Allocation (%) | Tokens (SAI) |

| Foundation | 37 | 136,530,000,000 |

| R&D | 10 | 36,900,000,000 |

| Liquidity | 10 | 36,900,000,000 |

| Community | 10 | 36,900,000,000 |

| Private Sale (cap) | 9 | 33,210,000,000 |

| Public Sale (cap) | 24 | 88,560,000,000 |

Figure — Token Allocation Caps (SAI)

9. Sale Structure (Option A) — Raises Fixed at $5M + $20M

9.1 Pricing Terms (Compliance-Safe)

All sale terms are expressed as pricing differentials relative to a listing reference rate, not as expected value or performance.

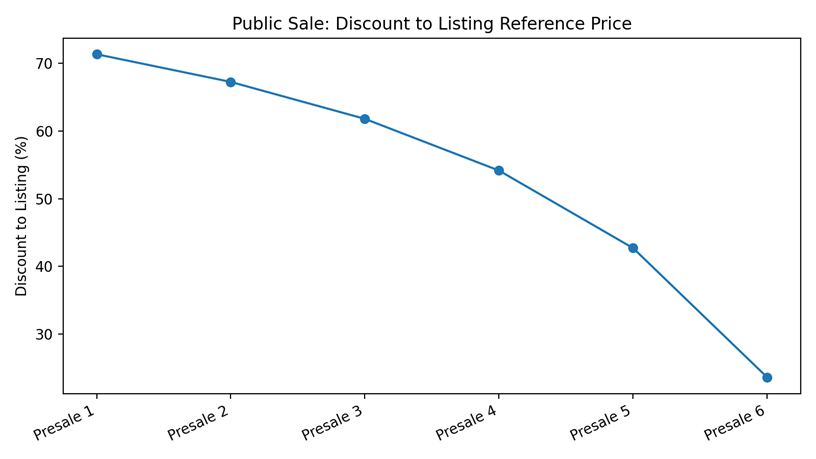

Listing reference: 550 SAI per USDT. Presale rates: 1920 / 1680 / 1440 / 1200 / 960 / 720 SAI per USDT.

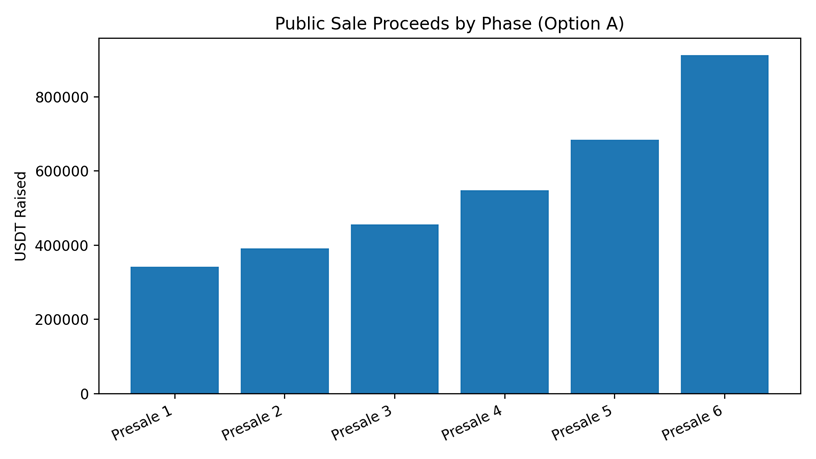

9.2 Public Sale (24% Cap; Controlled Release to Raise $20M)

Public Sale program cap equals 24% of total supply. Under Option A, the protocol releases a controlled subset of the cap: 3,941,348,974 SAI across six phases to raise exactly $20,000,000 at the specified phase rates.

| Phase | Rate (SAI/USDT) | Tokens Released (SAI) | USDT Raised | Discount to Listing (%) |

| Presale 1 | 1,920 | 656,891,495.6012 | $342,131 | 71.35% |

| Presale 2 | 1,680 | 656,891,495.6012 | $391,007 | 67.26% |

| Presale 3 | 1,440 | 656,891,495.6012 | $456,175 | 61.81% |

| Presale 4 | 1,200 | 656,891,495.6012 | $547,410 | 54.17% |

| Presale 5 | 960 | 656,891,495.6012 | $684,262 | 42.71% |

| Presale 6 | 720 | 656,891,495.6012 | $912,349 | 23.61% |

Figure — Discount to Listing Reference Price (Compliance-Safe)

Figure — Public Sale Proceeds by Phase (Option A)

9.3 Private Sale (9% Cap; $5M Target)

Private Sale program cap equals 9% of total supply. To raise $5,000,000 without exhausting the cap, the recommended access pricing is 1,773.61 SAI per USDT (released tokens ≈ 8,868,050,000 SAI).

10. Trading Market Design

10.1 Trading Fee Policy

Marketplace trading fee: 25 bps (0.25%).

10.2 Fee Routing (Base + Governance Bounds)

| Destination | Base (%) | Governance Bounds |

| Staking Rewards Pool | 35 | 30–40% |

| Treasury Reserve | 25 | 20–30% |

| Policy Burn Budget | 20 | 15–25% |

| Liquidity / MM Support | 10 | 5–15% |

| Operations & Audits | 10 | 5–15% |

10.3 Liquidity Bootstrapping Strategy

• Genesis liquidity seeded under treasury policy and time-locked LP tokens.

• Time-decaying incentives for liquidity providers and market makers to improve execution quality.

• Expansion to additional venues after depth and stability benchmarks are met.

10.4 Slippage Controls

• Dynamic fee curves for outsized trades, TWAP execution support, and minimum depth checks.

10.5 Circuit Breakers & Volatility Controls

• Temporary halts or fee escalation if rapid price deviations, liquidity drops, or reference discrepancies are detected.

11. Retirement, Burn, and Rewards

11.1 Retirement Finality

Retirement permanently removes carbon units from circulation by burning cSAI on-chain.

Registry adapter reconciliation produces an evidence artifact (receipt/attestation), whose hash is anchored on-chain to provide immutable proof.

11.2 Retirement Fee Policy

Target retirement fee: $0.15 per tCO2e (suggested bounds: $0.10–$0.25).

11.3 Rewards (Usage-Funded Participation)

Participation rewards are funded by protocol revenue (trading fees, retirement fees, enterprise services) and governed within bounded policy parameters.

11.4 Sustainability Condition (Conceptual)

Long-run objective: burns (retirement burns + policy burn) should be sufficient relative to any incentive emissions to avoid persistent supply inflation.

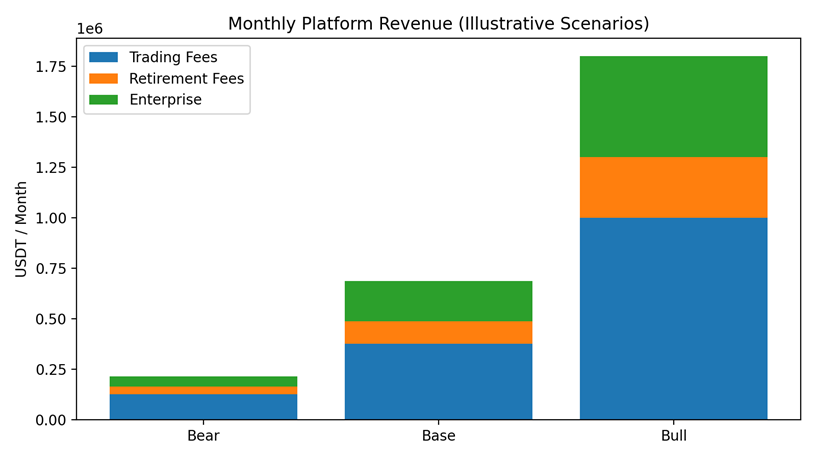

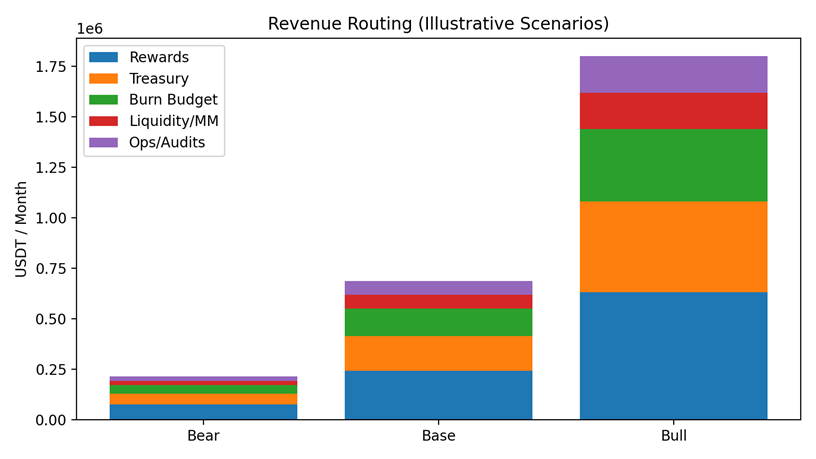

12. Platform Revenue Model & Scenario Simulation (Illustrative)

Revenue formula:

Rev = (Trading Volume × 0.25%) + (Retirements × $0.15) + Enterprise Revenue

| Scenario | Trading Fees (USDT) | Retirement Fees (USDT) | Enterprise (USDT) | Total Revenue (USDT) |

| Bear | $125,000 | $37,500 | $50,000 | $212,500 |

| Base | $375,000 | $112,500 | $200,000 | $687,500 |

| Bull | $1,000,000 | $300,000 | $500,000 | $1,800,000 |

Figure — Monthly Platform Revenue (Illustrative Scenarios)

Revenue routing (base policy):

| Scenario | Rewards (USDT) | Treasury (USDT) | Burn Budget (USDT) | Liquidity (USDT) | Ops/Audits (USDT) |

| Bear | $74,375 | $53,125 | $42,500 | $21,250 | $21,250 |

| Base | $240,625 | $171,875 | $137,500 | $68,750 | $68,750 |

| Bull | $630,000 | $450,000 | $360,000 | $180,000 | $180,000 |

Figure — Revenue Routing by Scenario (Illustrative)

13. Treasury Policy & $100M Inventory Objective

The platform inventory objective (~$100M equivalent) is supported via two channels: (i) treasury-seeded inventory facilities, and (ii) verified third-party inventory onboarding through registry adapters and authorized partners.

Treasury priorities:

• Maintain ≥ 18 months operating runway under conservative assumptions.

• Fund audits, security, and reconciliation workflows.

• Stage liquidity deployment under policy to support execution quality and market depth.

• Diversify inventory exposure where applicable (methodology, geography, vintages).

14. Initial Liquidity Provisioning (Best Practice Recommendation)

Recommended initial LP: $5,000,000 paired with 2,750,000,000 SAI at listing reference (550 SAI/USDT).

LP lock duration: 12 months.

Remaining liquidity allocation remains locked and is deployed under governance-controlled policy windows.

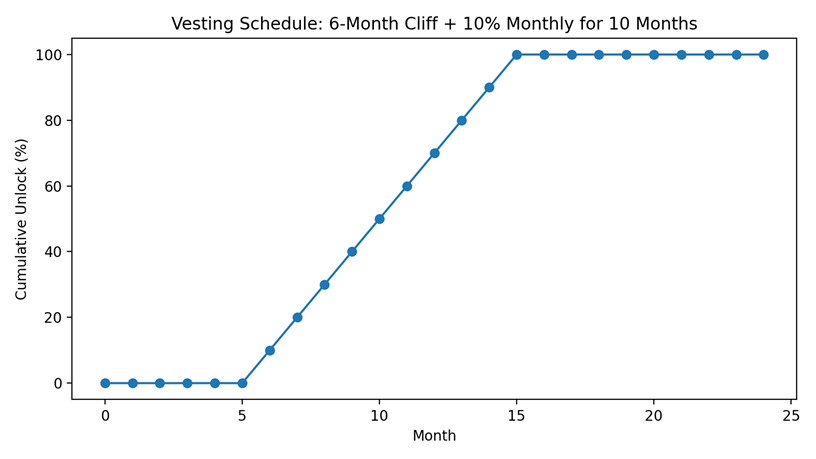

15. Vesting, Locks, and Circulating Supply Discipline

Vesting schedule for Foundation, R&D, Community, and released private tranche: 6-month cliff then 10% monthly over 10 months (fully vested by month 16).

Figure — Vesting Schedule (Cumulative Unlock %)

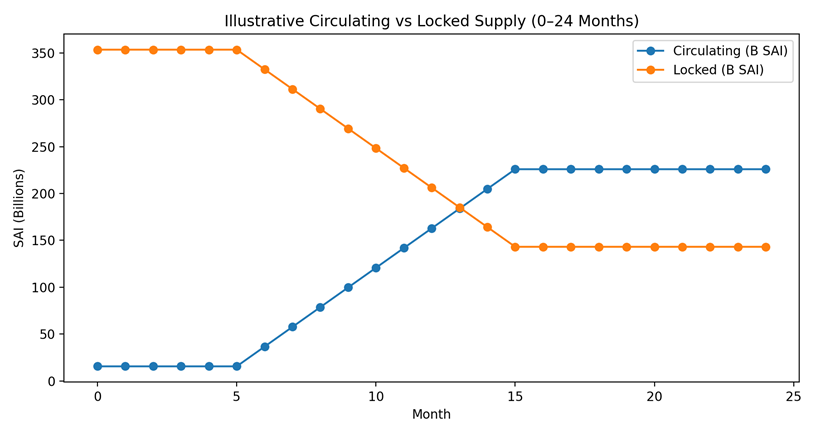

Illustrative circulating vs locked supply (simplified view including released sales, deployed LP, and vested caps):

Figure — Illustrative Circulating vs Locked Supply (0–24 Months)

16. Governance, Controls, and Compliance Operations

Governance is phased to prioritize safety and auditability:

• Phase 1: multisig control + documented operating policies (treasury, onboarding, risk controls).

• Phase 2: bounded on-chain governance for parameter changes within predefined limits.

• Phase 3: broader governance with emergency controls and risk committee oversight.

17. Security, Audits, and Resilience

• Independent smart contract audits prior to launch.

• Bug bounty program post-launch.

• Continuous monitoring and incident response procedures.

• Treasury controls via multisig with explicit approval thresholds.

18. Roadmap

Q4 2025: Whitepaper finalization, platform buildout, private sale close.

Q1–Q2 2026: Public sale phases, onboarding external inventory, marketplace + staking go-live.

Q3 2026+: ecosystem expansion, enhanced markets, additional registry integrations, enterprise reporting suite.

19. Legal & Regulatory Appendix (Utility Token Positioning)

SAI is intended solely as a platform utility token required for functional use within SAICCP. It does not represent equity, ownership, dividend rights, profit participation, or claims on assets. Sale terms are expressed as access discounts relative to a listing reference price and do not represent expected market performance.

SAICCP applies compliance-by-design and may apply access controls (including geofencing and KYC/AML) where required.

20. Risk Disclosures (Non‑Exhaustive)

• Regulatory interpretation risk across jurisdictions.

• Smart contract and cybersecurity risk despite audits.

• Carbon integrity and counterparty risk (registry, issuer, verifier).

• Liquidity and volatility risk.

• Operational risk in reconciliation, reporting, and controls.

Appendix A — Formulae and Definitions

Public sale token release (Option A):

Tokens_per_phase = (Public_Raise_Target / Σ(1/r_i)) / 6

Revenue model:

Rev = (Trading Volume × 0.25%) + (Retirements × $0.15) + Enterprise Revenue

Routing:

Rewards = Rev×35%; Treasury = Rev×25%; Burn Budget = Rev×20%; Liquidity/MM = Rev×10%; Ops/Audits = Rev×10%

Vesting:

0% until month 6; then +10% monthly for 10 months (fully vested month 16).

Leave a Reply